Engagement & Retention project | EAM360

Pro tip : Quirky literary and cinematic references all over this project. Can you collect them all?

Prologue

Dearest Gentle Reader 🎀,

Yay! We're doing E&R for a product that's mandatory to use once purchased by enterprises (you can't drop off) and everyone pretty much has a standard use for it (you can't get too creative)😨.

So, how do you tackle E&R for a product like that?

Imagine you've got a pen.

What do you do with it? Sure, you could draw a line.

But you could also write poetry. Nibble at the tip, balance it over your nose. Stain your fingers in indigo ink. Even chart out a trajectorial plan that will change your life.

In both cases, it is not the pen, that is always there, who has decided. It is you, the user, who has created all the difference between a simple line and a world of possibilities.

With that understanding, let us turn to EAM360, and explore what is like to simply carry the product along just because boss lady told you to, and truly use it to efficiencize tasking and make your own life simplified on field. And in that bridge, is where you find the true value of the product.

Let us, together, look at E&R as a powerful impact-driver that shapes how technicians work real-time everyday.

Chapter 1 : Understand and define

Let's go back to the beginning of why EAM360 was created.

Over the past 2 decades or even more, we have been constantly talking about digitization as a core interest of infrastructural enterprises. The need of an organized system of handling infrastructure and assets has led to the rise of ERP, and in consequence, EAM - Enterprise Asset Management.

Years later, various tech giants have created multiple technology solutions for EAM and CMMS including the likes of SAP and IBM's Maximo.

After these were created and fully adopted within the larger ERP structure, though, some core needs of technicians were still left to be addressed.

"Every little thing is filled with paperwork! 🤦"

"I travel to far-off remote locations with 0 connectivity. Just how do I record all this information you need precisely?" 🙁

"Man, some of this stuff is pretty complex. I'm super new to the workforce and I don't understand anything! 😭"

Well, it was the best of times, it was the worst of times.

That's when EAM360 (of course, with other similar products!) was invented.

EAM360 is, by definition, a mobile solution for IBM Maximo. It is a "skin" over IBM Maximo that adds a simplified layer between the user and the ground software.

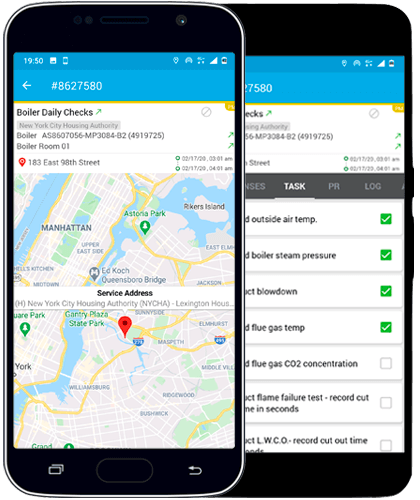

Users of EAM360 get to handle EVERYTHING they need using a simplified mobile interface. It could be anywhere from tracking and updating work orders, viewing a distributed geospatial map that helps them track assets real time, handle specific types of inspections and so much more.

Here's a look at some of the modules pretty commonly used and also mentioned above:

This not just made Maximo asset management a whole lot more convenient for users, it also made tasking fully mobile!

And that brings us to the core value proposition of EAM360 - what are the CVPs and how do users tend to experience it?

Understanding the Core Value Proposition

EAM360’s greatest value to users is the fact that it offers complete and comprehensive mobility for IBM Maximo users. Users are able to view their day-to-day tasks directly on their mobile devices, view extensive information about their tasks no matter how far they are from their workplaces into the worksite, and very easily collect extensive necessary data through various multimedia options.

- Handle all your tasks on a mobile device: No more needing to log every single task into IBM Maximo. Use EAM360 instead for a more simplified, consolidated view of your Maximo workflows.

- Go offline, stay on track: Offline mode with EAM360 helps tackle every single task and retrieve information even in completely remote areas.

- Ditch the paperwork: With EAM360, eliminate the use of paperwork 100% by completely digitizing and automating tasks.

- Increase productivity: Get work done faster on mobile, increase TAT and reduce response times.

How do users experience the CVP of the app?

Some major actions that help them experience the CVP include:

- Completing work orders by adding, updating and signing off tasks

- Capturing any form of multimedia attachments like images, videos, audio etc

- Using SR, assets and MR module to contribute to overall seamless asset tracking in the enterprise

- Employing a chosen integration such as Beacons, Scanners, ArcMaps.

- Completing work actions in offline mode, i.e., using EAM360 in remote locations with little/no connectivity.

- Reacting to notifications of new work orders assigned by alerts from mobile devices.

- Getting alerts of tasks and safety hazards using geofencing capabilities

...and more.

What would be the natural frequency of EAM360?

Let us bring back one of our ICPs, David.

David is a maintenance engineer who is responsible for handling his maintenance tasks assigned to him in a week. Like many others in the organization, David works on a shift basis, and has an 8-hour shift every working day of the week.

During every shift where he is assigned work orders, David carries EAM360 to his workspace and uses it extensively in that time.

That is why we classify the natural frequency of this product as 5 times a week, or daily every working day—for this particular ICP that makes up the largest cohort of its users.

Are there any sub-products within EAM360 Technician?

EAM360 the brand itself has 4 role-based apps—Technician, Storekeeper, Inspector and Manager.

The product we have chosen to explore in this project is the EAM360 Technician app, as these can all be classified as distinct products used independently by different organizations and roles.

Now, does EAM360 Technician (let’s call it just EAM360 for simplicity) itself have a sub-product?

Yes, we do have a product called EAM360 Inspector, which is by itself a stand-alone product (think of it like a spin-off series). However, it can also be purchased within the existing product as an individual module for users who wish to perform both functions. So the goal of the project is to "down-sell" users the Inspector app instead of Technician if there is a risk of churn, and not the other way around.

Let us try to arrange this information:

| EAM360 Technician | EAM360 Inspector (sub-product of Technician) |

|---|---|---|

Used by | Maintenance technicians and crafters | Inspectors, Condition monitoring staff |

Top modules |

| The main inspection module that helps users:

|

Core value derived | Users are able to view, create, update and consolidate all work execution tasks related to maintenance on their mobile devices ( mobile phones, tablets, smart watches, even laptops) even when they're completely offline. | Users are able to complete 100% accurate inspections by viewing routes, completing and signing off inspections and capturing data. They are able to peruse the exact inspection schedule mentioned as per their workflow in IBM Maximo. |

Natural frequency | 5 times a week throughout their shifts. | Generally, inspection schedules vary according to each organization's policy, there is no concept of "natural frequency." |

What action makes for an active user?

For EAM360 Technician, the natural frequency we've already calculated indicates that it is a daily (working days!) product.

Assuming that our ICP David's primary JTBD is completing his assigned work orders on asset maintenance, which is why he has "hired" the product - we average about 10 work orders per day. That means, for David to be an active user, the metric is -

Completing 70 work orders in 1 month makes David an active user of EAM360 Technician.

How about EAM360 Inspector? If David's tasks for one month is solely inspections (remember, he could be doing this along with his other tasks during the rest of the year too), that means he is assigned around 1 inspection task every week.

What is his activation metric?

Completing 4 inspection tasks in 1 month would make David an active user of EAM360 Inspector.

Chapter 2: Deep-dive into Engagement

At this point, we've coasted through a deep-dive of who our users are, what value they derive from our product, and how they experience the value of our product as an active user.

We’re going to start off with user segmentation by identifying our ICPs and mapping them into two segments that matter the most.

- How do different ICPs engage with the product?

- Are they Casual, Core or Power users of our product?

- What features do they value the most?

In the upcoming sections, we shall explore why we pick these specific types of segmentations.

Natural frequency, again

Before all that, let us try to understand the natural frequency of the product. EAM360, once purchased by the organization, is often (but not always) mandated to be used to complete tasks. This means there is no possibility of drastic differences in the natural frequency of usage when it comes to number of days used.

We can, however, think of frequency in another dimension - how many times a user actually uses an app per shift. This is quite granular to think about seeing as there is no standard across the world for the number of transactions per shift.

But let us hypothesise like this -

Conventionally, we know that a shift (day) carries about 10-12 tasks allocated, and updating data to a bare minimum only takes around 10 minutes per task : then the most basic user will use EAM360 only for around 120 minutes, or 2 hours per day. The most powerful user would notch this up to a solid 25 minutes per task, since they could use extensive features like maps, image capture etc. That would mean they spend up to 4 hours per day on the app.

Let us try to retain this logic to help segment users into casual, core, power users.

Who would be the Casual, Core and Power users of EAM360?

- A casual user would simply view their day's work orders and update tasks on the app. They would probably take a maximum of 10-15 minutes per task to read instructions, details and update data. They also don't interact much outside their expected module.

- A core user would extensively use their main module and take support from 1-2 related features. They could use it to navigate to locations, complete entire cohorts of tasks, and also have a basic IoT integration they use along side.

- A power user makes use of at least 4-5 important modules such as work management, SR allocation, asset management, collaborating with storekeepers etc. They are also prone to use extensive integrations. They could be enough valuable to them that they are unable to go about their day's tasks without EAM360.

| Modules used | Natural frequency |

|---|---|---|

Casual |

| 2 hours a shift |

Core |

| 3.5 hours a shift |

Power |

| 5 hours a shift |

Notice how even if the natural frequency does not drastically vary, the number of features and objectives vary considerably.

That is because even if a basic natural frequency is mandated by their employer organization, level of engagement drastically differs based on the value perceived from the app. This is also substantiated in the retention graph we will explore later on.

Segmenting by ICP and features

Let us explore 3 ICPs of EAM360 and how they tend to interact with the product.

| ICP 1 | ICP2 | ICP 3 |

|---|---|---|---|

Name | David | Julie | Arthur |

Designation | Maintenance Engineer | Maintenance and Quality Engineer | Crafter |

Age range | 22-25 | 28-30 | 22-25 |

Level of technological sophistication | Medium | High | Low |

Industry | Life sciences | Public utilities | Utilities |

Location | USA | USA | Canada |

Company size | 200+ | 150-300 | ~200 |

Annual income | $75K | $90K | $65K |

Shift/ regular employment | Shift | Regular | Shift |

Number of working days a month | 20 - David is called in to work only 20 days a month on a shift basis | 25 - Julie is a standard employee | 20- Pretty similar as in the case of David |

Used IBM Maximo before? | Yes | Yes | Yes |

Used mobile app before? | Yes | No | No |

Top challenges with job that brought you to EAM360? |

|

|

|

JTBD with mobile app |

|

|

|

Natural frequency | Every time there is a shift, i.e., 20 times a month | Every inspection task, i.e., 4 times a month | Every time there is a shift, i.e., 20 times a month |

Segmentation by features | |||

Top features used |

|

|

|

What are your top 3 most used features out of these? |

|

| Same as above |

Any features you don't feel the need to use at all? | I don't use features like ChatGPT and BIM much, but that is also due to my role. | I don't really raise too many MR's via the app. Also don't use too many integrations like Beacons or Zebra scanners. | Besides from the most used ones, I don't know any of the other features and don't use those as well. |

Any pain points with the current app? | This is a very heavy app with so many options and I might get overwhelmed sometimes, but I do not have any concerns! I'm loving it so far! | I feel like we are not using the features well enough to its full extent. Not all the modules are applicable to me as well. If only I was able to find a variation with only the specific types of requirements used! | t's less about the app itself and more about the job at hand. |

Favourite part of the app, if you could pick one? | Offline mode! That's the best part, I can simply use it offline with no impact and have data autosync. Very valuable when I am using it. | I really like the extensive inspection form and flow. It encompasses everything I need and directly updates to Maximo. It's also made unscheduled inspections a breeze. | I like how simplified the app is. For the purposes that I do use it |

C/C/P? | Power | Core | Casual |

Figuring out what works : Engagement frameworks

There are 3 possible associations we can make here for engagements - breadth, depth and frequency.

Let us try to understand what each of them mean in our product context, and which of those would work logically for EAM360.

| Key tracking metric | Selected | Rationale |

|---|---|---|---|

Frequency | Number of times the | ⛔ Not selected | The product could simply be opened as a source of info |

Breadth | Number of modules outside | ✅ Primary | This is selected as the primary framework |

Depth | Number of assigned tasks | ✅ Secondary | This is secondary to breadth because using the same module |

Designing engagement campaigns

Based on our understanding of user segments, and the need to bring casual users to core and core users to power, let us try to create 5 engagement campaigns.

Our engagement framework is breadth based - that means we want to invite more users to actively make use of multiple modules within EAM360, and also opt in for EAM360 Inspector where needed.

We’ll create 3 campaigns to help shift casual to core and 2 to go from core to power.

Goal | Hypothesis | Pitch | Details | Offer | Content | Campaign frequency and timing | Success metric |

|---|---|---|---|---|---|---|---|

Casual to core | Unsure what other features can be used in the product. | Module of the month - introduce helpful features based with personalized recommendations. | A push notification every 15 days inviting you to explore a personalized feature based on your maximum used module. You get a 10-second demo within the app to help explore the suggested feature. | Personalized recommendations of useful features to up your game. | Have you tried using ArcMaps? Try geospatial mapping to find scattered assets within minutes. | Push notification 2-3 times a month, repeat once every 3 months to gradually acquaint a user to a new use case. | Open rate of new modules (tracked within activity log). |

Casual to core | Unsure how to use a specific integrated device/ technology. | 30-minute live webinar collaboratively with the technology partner. | Once every 2 months, we can arrange client visits in-person with when possible or virtually, and in combination with technology partners to acquaint users with that specific tool. | In-person meetings and AMAs to resolve | Webinar: How Trimble devices with EAM360 helps identify assets upto 2cm accuracy. | Once every 2 months | Subscription to post-webinar newsletter. Increased activity in that specific module. |

Core to power | Does not want all portions of the huge app, would use better with selective added features. | Custom package with sub-apps. Speak at leadership level. | Try to tweak the existing subscription to include only contextually used modules and include ad-hoc add ons. This relieves the pressure of purchasing a larger app for required functions. Ex: EAM360 Inspector was created to address this issue. | Custom package with subsidized pricing. | Retro conversations with leadership team every 4 months. | Once every 4 months. | Increase in subscription revenue, opt-ins for newer modules. |

Core to power | Organization does not have a specific type of integration needed to function better. | Newsletters and promotions to senior managers about technology integrations. | Run targeted communication ads from DGM+ level about hardware integrations. For software integrations, provide a 2-month free activation for that feature. | Bring in a new integration with less effort and spending. | Try our ChatGPT integration for free for 3 months straight. Upload maintenance manuals and ask questions for instant insights. | Every 4 months OR every new release. | Regular usage of newer module, more sign-ups for demos. |

Core to power | Needs a specific customization to function better. | Offline syncups and field visits for understanding new requirements. | Create partnerships that are able to help with specific requirements and collaboratively approach customers with vendor proposals. | Customizations to help perform better and solve critical problems. | Do this before every release phase to add to the product roadmap. Get user consensus via emails. | Once every 4-6 months. | Increase in requests for specific features. Greater adoption post roll-out. |

With that, we hit the closure of engagement, however, jumping on to retention is going to help us understand this even more in depth.

Chapter 3: Retention and Resurrection

All happy users are alike, each unhappy user is unhappy in their own way.

That being said, we are going to look and define retention, churn, resurrection and more throughout this chapter to help us hold to users longer and firmer.

Hey, isn’t EAM360 mandated to be used by organizations post purchase?

Yes! Once the purchase is complete and the product is onboarded, users cannot simply stop using the app for their day-to-day functioning–it becomes a part of their workflows and they stick with it until the contract is closed.

What is mandatory is that every transaction performed does reach Maximo, however, that does not necessarily indicate that each transaction is directly happening through EAM360. It might certainly be a part of day-to-day operations, but can still abstain from using it for the required function and create a workaround by options like:

- Substituting with paperwork and directly inputting to Maximo

- Creating paper-based form and uploading in bulk to EAM360 off site (defeating the purpose)

and so on.

Retention here can be classified into 2 folds:

- Customer retention

- User retention

Let us pick these apart in sections and devise an understanding about why the numbers are the way they are.

Understanding customer retention

So what does retention look like? Here’s a bird’s eye view.

At a macroscopic level, EAM360’s retention rate is 100% 🚀😲.

And we don’t just say it's because “yer a wizard, EAM360” and leave it at that.

Every single one of EAM360’s acquired customers continue to stick with the product till date and have not churned out by cancelling contracts and terminating support.

EAM360 also has customers who increase license purchases as their organization size grows.

Let’s assess why:

- EAM360 is heavy on purchase cost and lighter on support—it works well on perpetual licensing model. Support is a very minimal spend for the kind of organizations we cater to which organizations typically don't mind paying.

- It is very difficult to switch between enterprise class mobile apps at a rapid rate. Once purchased, any mobile app in this space is likely to be a permanent solution for an organization.

- The organizations can revert to their old methods even leaving the product unused without major impact. There is no urgent need that is directly solved by the product an organization cannot function without and would look for alternatives to. So customers could still be "retained" on paper even if the app serves only an ancillary purpose.

- Last but most important reason—quality of product 🙂this category of product comes with heavy change management, and once comfortable, organizations typically do not feel the need to switch. EAM360 is one of the top 4 most favoured apps in this market.

So, does this mean that every single user across the board is retained for EAM360 without any churn? Absolutely not. Like every other product, EAM360 has its own share of churn.

This, however, can be measured through how specific users churn and how certain users are retained by continuing to use the product end-to-end.

Understanding user retention

User retention is a completely different ballgame—for a product that demands so much change management and adoption, it is evident that not all users and departments would be open to having a mobile app included in their operations.

Though casual users have a very steep drop off, core and power users form a majority of the user base and have pretty steady retention curves which is why there have not been any major customer-level churn.

The most logical way to approach retention would be not at ground-user levels but at a clustered department level.

That is because retention happens with the overall teams within a specific department, which reflects into churn as well. Let us calculate the curves with the help of data available.

Here is a chart that shows the retention numbers for Casual, Core and Power users, along with their retention % in the Y axis:

Observations::

Note (Retention even within departments will not vary much on core vs power users - if your department has mandated the app, you do not get to drop off that easily!)

- It takes barely 2 months for casual users to reject the app and quickly drop on the curve - even though experiencing the core value prop takes quite a while. That means that the first 2 months of adoption make a heavy impact on whether or not they reach the activation point, and it is very difficult to resurrect them after that.

- Core users have a sweet spot of 4-6 months for the retention curve to flatten and to remain stable. In fact, once core users (and in the case of power users) understand and experience the value proposition, they will be highly reliant on the app as an entire department, drastically reducing drop off numbers.

- Power users and core users don't have too different curves - that is interesting because we are calculating engagement more on number of features than frequency. Power users too have a pretty steady drop off rate at first, but even out equally fast (5-6 months), seeing that they end up sticking to the convenience of a particular feature and do not feel the need to make an overall exit.

Deep dive into retention

Let us evaluate the retention based on a couple of factors such as ICPs, their acquisition channels and what features or sub-features they have used the most.

| ICP 1 | ICP2 |

|---|---|---|

Name | David | Julie |

Designation | Maintenance Engineer | Maintenance and Quality Engineer |

Department name | Maintenance Monitoring | Quality assurance |

Industry | Water treatment and utilities | Life sciences |

Org size | 250+ | 200-250 |

Acquisition channel | Direct sales via RFP | Outbound - reached out via event |

How frequently you use the product? | Every shift cycle | 3 times a week |

How long have you been using the product for? | 8 months | 2 months |

What are your top 3 favourite features? |

| So far inspection management is the most used. |

Any features you want to try out further? | Beacon integrations, printer integration | The ArcMap feature looks pretty good. |

Will your department continue using the app in the next 6 months? | Yes, we have pretty much adopted to it | About half our team is already using the app pretty regularly but yet to reach a consensus. We are inclined to drive adoption to the whole team. |

These are the kind of ICPs that drive maximum value - those who are using it to the activation point - completing work orders, logging in at least to the minimum number of times per week.

Now, what are the acquisition channels that drive maximum retention?

Insight from the sales team : the maximum adoption and retention always comes from the users who have actively pursued and tried out the product even before the purchase.

Generally, those teams that have tried out a "trial" period with a pilot/demo instance have had rapid adoption cycles compared to others.

What are the top 2 acquisition channels?

Note: Here, all numbers are measured in terms of # of departments / total # of departments. Ex: 70% retention rate means 7 out of 10 departments are using the product.

Channel | Retention rate | Reasoning |

|---|---|---|

👑 RFPs | 81% | Barely 1-2 departments tend to drop |

⭐ Events | 73% | Again, teams have actively scouted for |

Partnerships | 50% | The teams could primarily value the partners' |

Web/ email campaigns | <50% | Change management is heavy on outbound |

Let us do the same exercise by feature, and try to understand what features and sub features drive the most retention rate.

Segment | Retention rate | Notes |

|---|---|---|

Uses at least 1 integration | 78% | Integrations are critical to core and power users. They are one of the main USPs of EAM360. |

No integrations used | 65% | |

Uses inspection module | 79% | The technicians who use the inspection module besides |

Does not perform inspection | 73% | |

Needs offline mode | 75% | Those who work offline to maintain distributed assets are a lot more reliant on the app, since it is their main and often only source of connectivity to the main systems. |

No offline mode | 69% | |

With the above few exercises, we have devised what kind of users are the most likely to stick with the app through the longer run.

Now, it is time to figure out where the users are churning out - and how we can bring them to the other side.

Exploring burn, churn and re-return

So, what does churn look like for EAM360?

First things first, let's talk about what happens when a user actually end up churning.

Do they simply opt in for another product, are they open to exploring other vendors and their offerings?

…well, not really.

When users churn, they typically stop using a mobile product from this entire space, and go back to the Old Ways of paper-based and manual systems. That means that the entire change management efforts have been wasted, and they are, in-fact deterred from exploring a competing product as well.

That means the entire market takes a hit every time a company decides to churn out and stay clear of the mobility for Maximo space.

Let's talk voluntary and involuntary churn

What are some of the voluntary and involuntary reasons a user might churn out for? Let's tabulate in the image below:

Now, we have our top voluntary reasons for churn that include:

- Poor user adoption - a lot users do not use the app to its needed capacity

- Ineffective change management - people do not realize how they can achieve the CVP of the product

- Don't understand the app - Could be caused by ineffective training or orientation

- Expectation unmatched - they had a different idea of what the app could do, or the app fails to help them , has bugs etc.

Red flags 🚩🚩🚩: What are some negative actions you would look for?

| Action |

|---|---|

Opens and clocking in | Skips logging in |

Reduced app open rate per shift | |

Interactions outside app | Fewer push notifications clicked |

Within task list | Fewer WOs marked complete on mobile |

| Stops accessing integrations module |

| Fewer # of features per work order |

Abruptly leaves app when a task in in-progress more often | |

Support monitoring | Greater # of support tickets rates |

Sudden increase in escalations | |

Negative feedback from leadership teams | |

Payments | Delay in support payments |

| Requests for extension |

Now that we have some negative actions that correlate to our voluntary churn reasons, let us start off by creating resurrection campaigns that can prevent a user from completely dropping off from being a mobile user.

Resurrection campaigns

Here are 5 resurrection campaigns that can bring in-danger segments back to active states.

Segmentation | Pitch | Details | Offer | Frequency | Success metrics |

|---|---|---|---|---|---|

Casual users close to drop off within first 4 weeks | WO marathon offers where teams unlock | This is actively monitored by SPOCs during launch along with any | One heavily discounted integration, ex: | Only during first 4 weeks. | Completion of first 100 WOs. |

Casual users close | Unlock free upgrades to | Send push notifications to users who are showing steady decline in number of work orders completed over the first 3 months. | 3 month free use of "cool" feature like | Once in first 3 months AND after | Steady increase in number of |

Power/Core users leaving tasks halfway | Out of the box accelerator or customization | Take a proposal to senior managers and directors about including a free | Free/subsidized industry-specific accelerator | One in 10-15 months. | Rapid adoption to new customization. |

Core user finding frustrations | Priority ticket handling and resolution, | Regular monthly meetings to gauge total number of tickets logged and | Quicker ticket resolution and priority needs | One in every month via meetings. | Reduction in number of support tickets logged. |

Organization heads showing negative behaviour due to budget constraints | Heavy discount / waivers in 1 year support | This is to deflect a potential termination of contracts by addressing budget | One-time deference or waiver in payments. | Once in a lifetime | Contract renewals, re-commitment to product |

Some of these resurrection campaigns might initially look like they go against the rule and consume a heavy budget - however, the cost here subjectively is just a fraction of what the company will lose on a cancelled contract long-term. That is why they are confidently feasible approaches.

Beyond the ideas of right and wrong campaigns, there is a field. We shall meet our resurrected users there.

Epilogue

The true key to apt engagement and retention in this product (like others, too) lies primarily in sculpting the attitude of users to drive more adoption. When users decide that they simply do not like the idea of the product (not even the product itself), they will churn rapidly and cause a hit to the entire market as mentioned above.

Engagement campaigns must be highly user-centric and work on a bottom-up basis - for it is the users who have the final say over the extent to which they end up utilizing the product. Retention should be a balance between a bottom-up and top-down approach - since the leadership teams who are not even direct users of the product hold heavy sway over ensuring it stays in the users hands.

And that might be the subject of a new story but our present story is over.

All's well that ends well, after all 😀.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.